Brandt King Cobra Shaker Screen

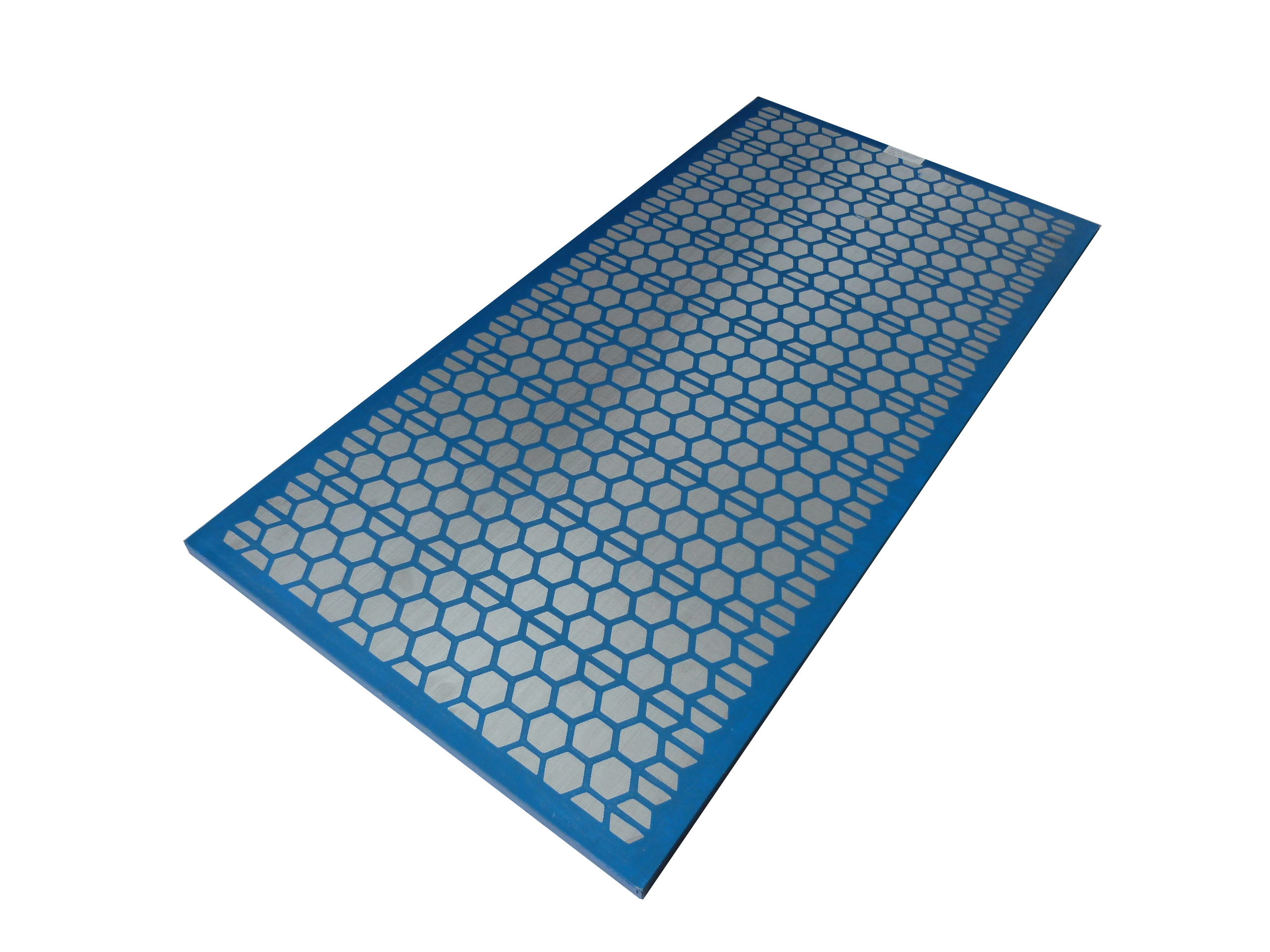

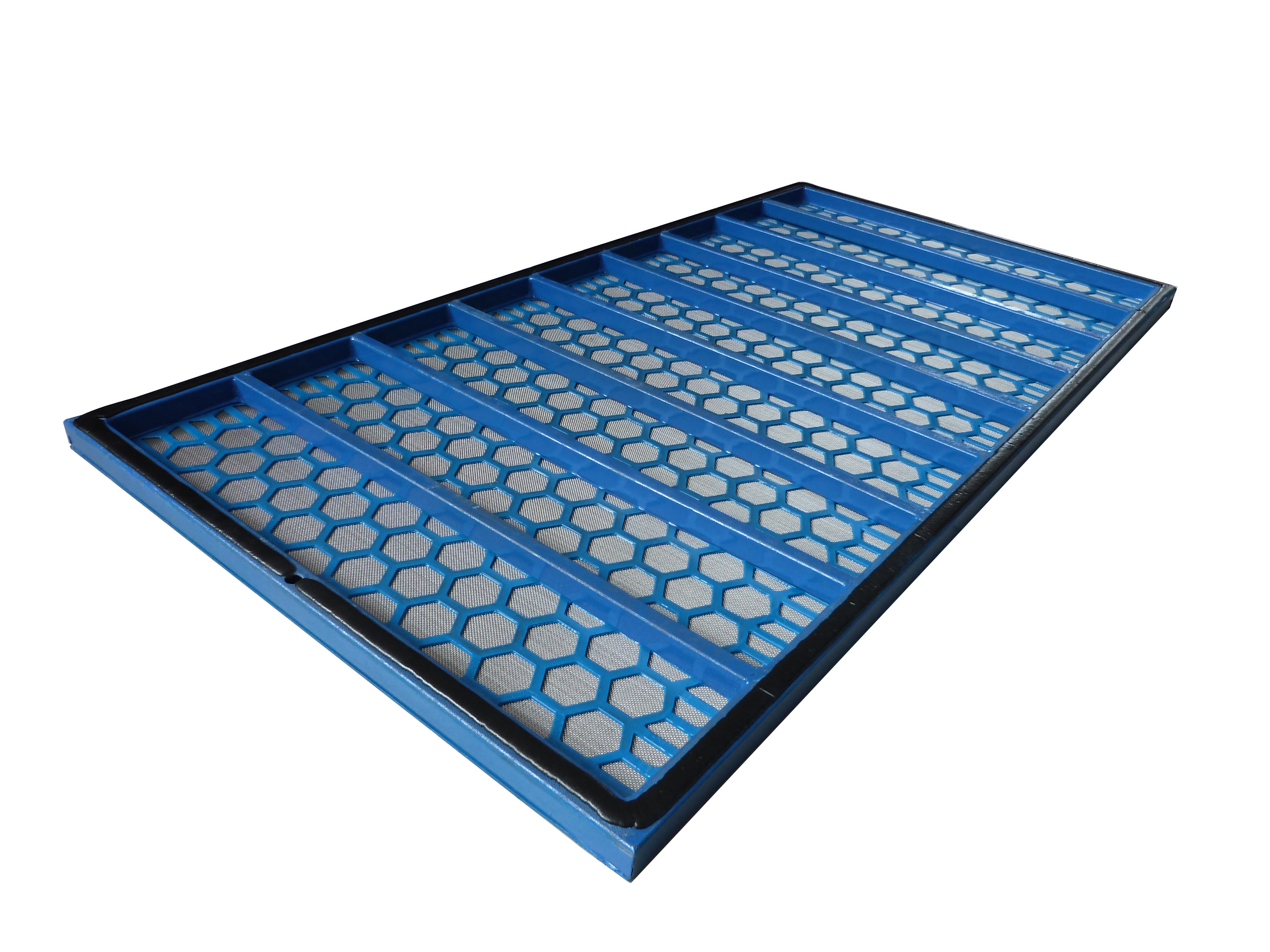

SJ-Brandt king cobra shaker screen(also Brandt Hybrid shaker screen) are produced as the replacement screen for Brandt King Cobra/Hybrid shale shaker. There are steel frame screen and PT frame screen for different drilling mud applications. Now our technical department has developed a new type of injection molding framework which is integrated with the rubber strip. This greatly improved the wear resistance of the shaker screens and effectively reduce the cost of mud treatment.

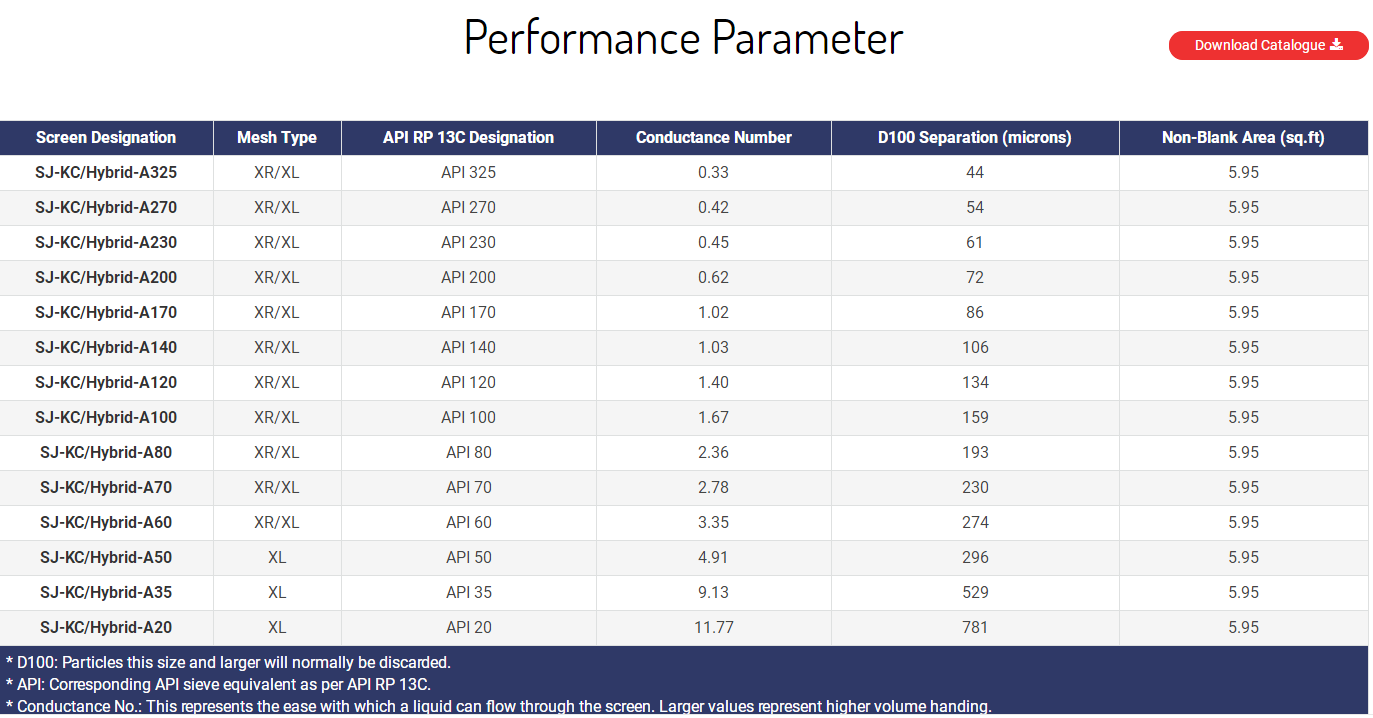

Technical Parameter

Adaptable Shale Shaker Model

SJ-Brandt king cobra shaker screen(also Brandt Hybrid shaker screen) are used as the substitute screen for

Brandt King Cobra Shaker Screen,Brandt Cobra Shaker Screen,Brandt King Cobra Shale Shaker Screen,Brandt Cobra Shale Shaker Screen Anping Shengjia Hardware Mesh Co.,ltd , https://www.oilshakerscreen.com

The agricultural machinery leasing market is in short supply and needs financial support.

Brandt King Cobra Shaker screen

Replacement Screens for Brandt King Cobra/Hybrid Shale Shakers

Competitive Advantage

The agricultural machinery leasing market is in short supply and needs financial support.

[ China Agricultural Machinery Industry News ] It is reported that some agricultural machinery enterprises in China have begun to act. Foton Lovol launched a leasehold financing lease product for the agricultural machinery market with a turnover of more than 530 million yuan. China Yituo, Jifeng Agricultural Machinery, Zhongnong Boyuan and other enterprises have also cooperated with some financial institutions to explore agricultural machinery financing leases. Although it is only the beginning, and there are certain risks. However, if the industry closed loop is designed like CreditEase Lease, the risk can be effectively controlled.

With the continuous improvement of China's large-scale agricultural production and mechanized production level, the demand for large-scale agricultural machinery and equipment such as high-performance, composite and intelligent farmers is becoming more and more demanding among agricultural professional cooperatives, family farms and large grain-growing enterprises. And the price of such machinery is hundreds of thousands or even millions, so that most people can't afford it. In particular, since the gradual implementation of the “full-price purchase, fixed subsidy†policy, the shortage of farmers’ purchase funds has become increasingly prominent. The emergence of agricultural machinery leasing business can change farmers from “direct purchase†to “first rent and then buyâ€, which greatly reduces the one-time investment pressure, and is expected to become a way to ease the difficulty of farmers purchasing and difficult loans.

The scale of agricultural machinery leasing is expected to reach 10 billion

"28 sets of large-scale cotton pickers with a price of 3.2 million yuan each, we will return home after 30% down payment, and the rest of the money will be paid off in 3 years. If you buy one-time full money, we can't get so much money. You can't afford so many money.†Bai Jiuhui, chairman of the Kangwang Agricultural Machinery Professional Cooperative in Sidaohezi Town, Shawan County, Xinjiang, said that a cotton picker can earn 80-100 million yuan a year, and it is not a problem to pay off in three years.

Kangwang Agricultural Machinery Professional Cooperative is the beneficiary of the agricultural machinery financial leasing pilot project jointly carried out by the Ministry of Agriculture and the Agricultural Bank of China Agricultural Bank Financial Leasing Co., Ltd. The agricultural machinery purchased through the pilot project only needs 30% of the full price of the down payment agricultural machine, and the balance is paid to the agricultural machinery dealer by the Agricultural Bank of China Agricultural Bank Financial Leasing Company. The cooperative will return the money to the Agricultural Bank of China Agricultural Bank Financial Leasing Company in three years. The three-year interest will be subsidized by the Ministry of Agriculture's financial project, and the ownership of the agricultural machinery will be attributed to the cooperative.

As a farmer's lease with both financing and melting functions, it is possible for China's new agricultural business entity to "do small things to do big things." Chen Peihua, president of the Agricultural Bank of China Agricultural Bank Financial Leasing Company, said that agricultural machinery leasing does not require other collateral, which is much more troublesome than bank loans. The financing quota for agricultural machinery leasing is much higher than the current bank loans, which can effectively solve the pressure of purchasing funds. Agricultural machinery financing leases can also choose different down payment ratios and repayment periods according to individual affordability, which is more flexible and the repayment pressure is relatively small.

According to some surveys, 89% of agricultural machinery cooperatives or family farms in the economically developed Jiangsu Province have agricultural machinery purchase loan demand, and demand exceeds 61 million yuan. “Although there are subsidies for the purchase of agricultural machinery, the shortage of farmers’ funds still accounts for a large gap. Due to the lack of collateral and credit records, farmers’ loan difficulties cannot be solved in the short term. This provides a broad space for agricultural machinery leasing to fully play its role, and its market capacity will reach The scale of 10 billion yuan," said Zhang Yiqin, president of Jiangsu Financial Leasing.

Li Weiguo, director of the Department of Agricultural Mechanization of the Ministry of Agriculture, believes that in order to solve the difficulties of farmers purchasing, in addition to direct support from the state, more financial means such as financial leasing and financial leasing should be used. In the past two or three years, in Xinjiang, Heilongjiang and other places, the development of agricultural machinery leasing began to show some good momentum and explored some experiences.

Win-win mode is the key to opening the market

The agricultural machinery leasing business has developed in the developed countries of Europe and America for hundreds of years. It is the way for farmers to purchase agricultural machinery and equipment, which can reach 60% to 70%. However, China's agricultural machinery leasing started late, and it is still in the stage of government promotion and pilot operation.

At present, in the company that opened the situation in the agricultural machinery leasing market, CreditEase Leasing is a representative. Since its establishment in 2012, CreditEase Leasing has provided agricultural machinery leasing services to nearly 10,000 farmers in more than 30 provinces including Shandong, Heilongjiang and Henan, and has established cooperative relationships with nearly 100 domestic and foreign agricultural machinery manufacturers and distributors, involving agricultural machinery and equipment. There are 180 kinds of 14 categories, which can meet the whole process of agricultural production, cultivation, planting, and harvesting.

“Building a 'farmer-agricultural machinery dealer-agricultural machinery production enterprise' win-win model is the key to opening the agricultural machinery rental market.†Mao Fangzhu, vice president of Yixin Company and general manager of Yixin Puhui Financial Leasing Department, said that our operating model can Summarized as: "You choose me to pay, quality control manufacturers. You rent me to buy, I buy you must rent. Want ownership, rent must be paid."

Since the farmers who rent agricultural machinery are quite scattered and most people do not have a past credit history, it is important to identify, screen and determine that the lessee controls the risk of the leasing company. “Actually, our direct customers are agricultural machinery dealers, not farmers.†Mao Fangzhu said that this is because agricultural machinery dealers are closer to farmers than financial institutions and can find target customers. Moreover, if the farmer defaults, the leasing company can retrieve the agricultural machine and cooperate with the dealer to repair the refurbishment and facilitate the second sale.

Agricultural machinery dealers are also happy to cooperate with Credit Suisse. “In the sales of agricultural machinery, the phenomenon of farmers’ selling is relatively common, which makes us have a lot of liquidity pressure. After the intervention of CreditEase Leasing, the farmers’ purchase money will be directly sent to us, which not only ensures the use of funds, but also eliminates the agricultural machinery. The problem of selling is difficult." Wei Guocheng, general manager of Kezuo Zhongqi Guohao Commerce and Trade Co., Ltd. said, and when we are tightly ordered by the agricultural machinery manufacturers, CreditEase will also provide financing services for us.

What is important is that the entire model can only be operated if the farmers are profitable. CreditEase Leasing establishes a “quality blacklist†to prevent farmers from buying inferior agricultural machinery. Focusing on the risk of agricultural machinery operations, CreditEase Leasing Joint Insurance Company has introduced relevant agricultural machinery property insurance and personal accident insurance to provide farmers with repayment guarantee. For those farmers who have better repayments, CreditEase Leasing will also issue a certificate of “Integrity Homeâ€, which can also provide financing services when they encounter shortage of funds in the production of breeding, planting and other production materials.